Guide to Land Trust Vs Living Trust

In the context of securing assets, the ‘Land Trust Vs Living Trust’ debate always pops up. Over the years, I’ve seen the benefits and nuances of both, and each serves a unique purpose depending on what you’re aiming for. Think of it as choosing between two paths that ultimately lead to safeguarding what matters most to you.

A land trust keeps your real estate dealings quiet like a silent partner holding the title. In contrast, a living trust offers broader asset protection beyond property alone, ensuring a smoother transition for all your assets when the time comes.

But here’s the kicker: deciding between a land trust and a living trust isn’t just about paperwork. It’s about envisioning your future. I’ve met people who value the anonymity that comes with land trusts, while others crave the peace of mind a living trust brings for their entire estate.

Also, the ‘Comparing land trust and living trust’ question boils down to one thing control. How much do you want, and how far do you want that control to stretch? That’s something only you can decide, but it’s always good to have these tools in your financial toolbox.

The Importance of Land Trust Vs Living Trust

With respect to safeguarding your assets, I’ve learned that the choices aren’t always clear-cut. There’s a fine balance between protecting property and planning for the future. In my experience, understanding the right kind of trust is crucial.

On one hand, trusts offer a way to hold property that can shield it from certain risks. But the type of trust you choose can significantly impact not only your control over the property, but also how it’s managed in the long run. I’ve seen clients struggle with the nuances, and it’s often the details that matter most.

I always tell people: consider your goals carefully. Do you need a trust that simply holds your real estate? Or are you looking for something more comprehensive, designed to manage your entire estate? The answer can change everything.

It’s not just about the paperwork it’s about peace of mind. After all, it’s your legacy on the line. Picking the right structure is like choosing the foundation for a house. Strong choices up front can save you from headaches later.

In the end, you’re not just setting up legal documents. You’re setting up security. Trusts are tools, but understanding which tool to use can make all the difference. Don’t rush the decision your future self will thank you.

Introduction to Different Types of Trusts

Trusts are fascinating tools that go far beyond the typical legal jargon. In my experience, each type of trust has a unique role, tailored to specific needs. Let me break down some of the more commonly used ones, so you can get a clearer picture of what they do.

Take revocable trusts, for instance. They’re like a flexible safety net – you can adjust them throughout your life, offering both control and peace of mind. I’ve seen them used often for estate planning where the grantor wants to maintain control over assets but needs a smooth transfer after passing.

Irrevocable trusts, on the other hand, are set in stone once established. Though they lack flexibility, their power lies in their asset protection. A good example I’ve encountered is their use in shielding assets from creditors or heavy taxes.

Now, there are special needs trusts, and this one always strikes me as one of the most compassionate forms of planning. It’s designed for beneficiaries with disabilities, ensuring they receive care and support without jeopardizing their eligibility for government aid.

Charitable trusts are another big one. If you’re philanthropic, this is a smart way to give back while receiving tax benefits. I’ve worked with people who use them to fund causes close to their hearts, all while strategically managing their estates.

Each trust serves its own purpose, and knowing the right one for your circumstances can be a game-changer. The world of trusts is deep, but when you start to explore, the benefits become crystal clear.

Overview of a Land Trust

When I first came across the concept of a land trust, I immediately saw how this tool can be a game-changer in real estate. Essentially, a land trust is a legal agreement where a trustee holds the title to a property for the benefit of another party, often the beneficiary. It’s a straightforward yet flexible vehicle that allows for privacy, protection, and efficient property management.

But what really sets land trusts apart is their versatility. You can use them for anything from estate planning to environmental conservation. Let’s say you own a large piece of land and want to protect it from being developed. With a land trust, you can ensure the property remains intact for future generations, all while maintaining control over how it’s managed.

Here are some key benefits that make land trusts appealing:

- Privacy: Since the property is in the trust’s name, your ownership remains confidential, shielding your assets from prying eyes.

- Flexibility: You have the freedom to dictate terms, manage the property, and even change beneficiaries if needed.

- Asset Protection: A land trust can shield your property from lawsuits, making it harder for creditors to lay claim to your assets.

From my own experience, the most appealing aspect is the peace of mind it offers. Whether you’re trying to limit your exposure or ensure a cherished piece of land remains untouched, a land trust provides that safety net without the complexity you might expect. But like any tool, it’s essential to understand its purpose and limitations fully.

So, if you’re juggling real estate investments or just trying to protect family property, a land trust might be exactly what you’re looking for.

Understanding the Purpose of a Land Trust

The first time I encountered a land trust, I didn’t quite grasp its purpose. It seemed like just another legal term, buried in paperwork. But over time, I realized its true essence: simplicity wrapped in a layer of protection.

At its core, a land trust separates ownership from control. You keep the benefits of owning the land, but your name doesn’t have to be in the spotlight. It’s like having a quiet guardian over your property, while you still make all the important decisions.

What really makes it stand out is its flexibility. Unlike many other legal structures, you can transfer assets or adjust the trust as life changes. It’s not rigid or intimidating it bends with you.

One thing I often tell people is that land trusts are not just for the wealthy. They’re tools for privacy, yes, but also for practicality. Whether it’s a family estate or an investment property, they allow for smoother transitions and more control over who gets what.

In a world where transparency is often demanded, having a bit of discretion with a land trust can feel like a breath of fresh air. And let’s be honest, sometimes that’s exactly what we need.

What is a Living Trust?

A living trust is not as complicated as it sounds, though it can seem like an enigma to many. Picture this: you have a treasure chest, and inside it, you place all your valuable assets your home, your investments, your prized collections. Now, instead of locking it up with a key and hoping it remains safe, you hand the keys to a trusted individual or institution, ensuring that your treasure is taken care of both during your lifetime and after you’re gone. This is essentially what a living trust does.

Here’s where things get interesting when you set up a living trust, you are in control while you’re alive, acting as the trustee. However, in case of incapacitation or death, a successor trustee steps in, handling the distribution of your assets smoothly, without the need for probate court.

-

Avoids Probate: Unlike a will, which needs to go through the legal process of probate, a living trust bypasses that hassle entirely. No courtrooms, no waiting periods. Just a smooth transition.

-

Flexible: You can modify or revoke a living trust as long as you’re alive and well. If you change your mind, it’s as easy as updating the document.

-

Privacy Factor: Unlike a will, which becomes public record, a living trust is a private arrangement, keeping your personal and financial details out of public eyes.

From my own experience, I’ve found the flexibility and ease of use to be a huge relief for individuals wanting to maintain control over their assets and avoid complications down the road. It’s like setting up your own personal insurance policy against future legal headaches.

Key Differences Between Land Trusts and Living Trusts

When people start diving into estate planning, the term ‘trust’ often comes up, and two types that frequently create confusion are land trusts and living trusts. From my experience, understanding the nuances between the two can make a big difference in how you manage your assets.

A land trust is specifically tied to real estate. If you’re primarily focused on protecting or managing property, this is often the go-to option. Here’s why:

- Real estate ownership: It allows you to maintain control of property while keeping your name off public records.

- Privacy benefits: Want to keep your ownership details under wraps? A land trust can help shield that from prying eyes.

- Limited application: It’s important to note that this trust is narrowly focused on real estate; it doesn’t extend to other assets.

On the other hand, a living trust serves a broader purpose. It’s designed to manage various assets, from real estate to investments and personal belongings. Here are a few highlights:

- Avoiding probate: With a living trust, you can ensure your assets pass to your heirs without the headache of probate court.

- Flexibility: You can continue to manage your assets during your lifetime and make adjustments as circumstances change.

- Comprehensive: This trust isn’t just for real estate; it’s for everything from your house to your stock portfolio.

In my view, a land trust is like a specialist, laser-focused on real estate, while a living trust is the generalist, taking care of your entire financial ecosystem. Which one is right for you depends on your goals, but either way, it’s smart to consult with a professional before making any decisions.

Legal Structure of a Land Trust Explained

The legal structure of a land trust can seem like a hidden world if you’ve never ventured into it before. Picture it like a secret vault where real estate ownership is tucked away, out of plain sight. The beauty? You still hold the key but your name stays off public records.

Now, why does that matter? Privacy is a rare luxury these days. With a land trust, you keep prying eyes from knowing what properties you own. It’s a strategic move that can shield you from lawsuits, creditors, or even nosey neighbors.

The land trust has a trustee, who technically holds the title. But don’t worry, the trustee is like a loyal guard dog following your directions to a tee. You retain all the benefits, like income from rent or selling the property, without losing control.

What’s also fascinating is that this structure makes estate planning smoother. If something happens to you, the property can seamlessly transfer to your heirs without the agony of probate court. It’s an elegant way to pass on your wealth while cutting through the usual red tape.

Of course, like with anything in real estate, there’s always fine print. Setting up a land trust might feel like weaving a complex web, but in the right hands, it’s a tool that works wonders. I’ve seen it turn tangled legal issues into clear, actionable plans for smart property owners. Just make sure you’re working with someone who knows how to wield it properly.

Legal Structure of a Living Trust Explained

When diving into the substance of living trusts, one finds an intricate context woven with legal threads. It’s a sophisticated arrangement that allows individuals to manage their assets while maintaining a cloak of privacy.

A living trust serves as a vessel for your property, ensuring it sails smoothly through the tumultuous waters of estate planning. Unlike a will, which is like a roadmap revealed after the journey ends, a living trust operates quietly behind the scenes during your lifetime.

The beauty of this legal structure lies in its ability to bypass probate. This means your assets can be transferred to beneficiaries without the lengthy court process. Imagine your loved ones receiving their inheritance without the weight of legal entanglements.

Moreover, a living trust provides flexibility. You can amend it as life unfolds marriages, births, or even a change of heart. This adaptability is akin to a garden that blooms and transforms, reflecting the seasons of your life.

It’s essential to appoint a trustworthy trustee to carry out your wishes. This role is pivotal, as it ensures your assets are managed according to your directives. Think of the trustee as a captain, steering the ship through calm and stormy seas alike.

In my experience, understanding the nuances of a living trust can be empowering. It gives you control, a sense of security, and peace of mind. When you consider your legacy, this legal structure stands out as a beacon of clarity amidst the fog of uncertainty.

A Comprehensive Look at Land Trust Vs Living Trust

Let’s dive into the world of trusts – a subject that may seem intimidating at first but becomes a bit clearer with the right understanding. In my experience, when it comes to structuring assets, it’s essential to grasp the distinctions between two types of trusts that people often confuse.

First, let’s talk about ownership and privacy. One trust offers a great deal of privacy by keeping your name off public records when holding property. The other focuses on distributing assets efficiently after you’re gone. If you’re a real estate investor, privacy might be at the top of your list, while someone planning their estate might prioritize smooth transitions.

Another major factor to consider is control. In one type, you still have control over the assets even though they’re technically under the trust’s name. The other? Once it’s set up, you’re handing over the reins to someone else – like a trustee – to manage things according to your wishes.

Here’s how they differ in key areas:

- Purpose: One’s primarily used for holding property discreetly, the other for handling asset distribution after passing.

- Beneficiaries: You might have more flexibility in changing who benefits from one of these trusts, while the other is pretty much locked in.

- Legal Protections: While both offer some protection, the focus of protection varies – either shielding property or simplifying estate processes.

As a matter of fact, don’t overlook the costs and complexity. In my experience, setting up one trust is a fairly simple, cost-effective process, while the other often requires more intricate legal guidance and upkeep.

It boils down to what your goals are – privacy, protection, or planning for the future.

Benefits of Using a Land Trust

When I first discovered the concept of a land trust, I was struck by how it simplifies ownership. It allows you to hold real estate privately, with your name out of public records. This kind of privacy can offer peace of mind, especially for those of us who prefer discretion.

A land trust doesn’t just offer privacy; it also makes transferring ownership seamless. For example, if you want to avoid the complexities of probate, you can easily transfer the title without the headache of public legal procedures. This is one of the many subtle advantages compared to other types of trusts.

But when people ask me about ‘Land Trust Vs Living Trust,’ the answer depends on your goals. A living trust, in contrast, covers all your assets, not just real estate. It’s a more comprehensive way to plan for the future, but it also comes with more legal strings attached. The land trust, on the other hand, is like the minimalist sibling it gets the job done with less hassle.

If you’re wondering why I personally lean toward a land trust, it’s the simplicity that wins me over every time. No complex legal frameworks, no red tape, just an efficient, private way to handle real estate. And in a world where things can get so tangled, simplicity is its own kind of power.

Benefits of Using a Living Trust

As it relates to estate planning, the benefits of using a living trust can feel like a hidden treasure waiting to be uncovered. Trust me; I’ve navigated these waters myself, and I can say that having a living trust in place can offer a sense of serenity amidst life’s uncertainties.

First and foremost, a living trust allows your assets to glide smoothly through the estate process. This means your loved ones won’t be stuck in a bureaucratic maze when the time comes to manage your affairs. Instead, they can focus on celebrating your life and memories.

Another gem is the privacy factor. Unlike wills, which become public documents, a living trust keeps your financial matters under wraps. Imagine the relief of knowing that your personal affairs remain just that personal.

Then there’s the flexibility that living trusts provide. You can tweak them as your life evolves, whether it’s adding assets or changing beneficiaries. Life is unpredictable, and having a tool that adapts to your circumstances is invaluable.

Additionally, let’s talk about incapacity. If you ever find yourself unable to manage your affairs, a living trust allows your designated trustee to step in seamlessly. It’s like having a safety net, ensuring your wishes are honored without added stress.

In my experience, the peace of mind that comes from having a living trust is simply irreplaceable. It’s more than just a financial tool; it’s a powerful way to protect your legacy and ensure your wishes are fulfilled.

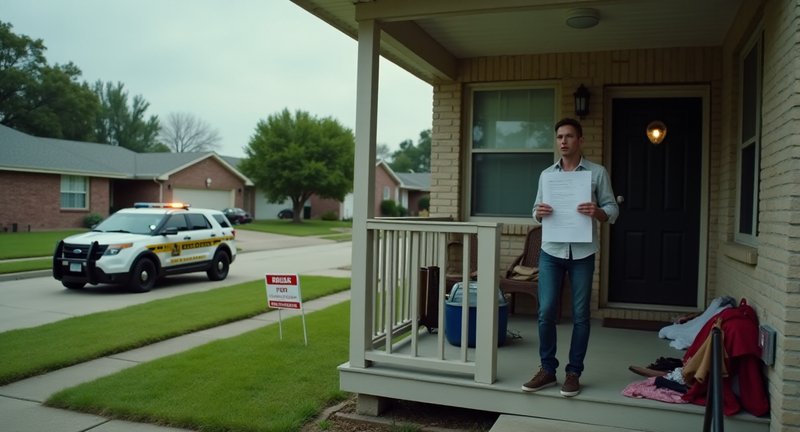

Land Trust vs. Living Trust for Real Estate Holdings

Regarding holding real estate, you might find yourself at a crossroads, considering two popular vehicles: a land trust and a living trust. Let me share my thoughts on these options based on my experiences.

Land Trust: A Cloaked Protector

- Privacy Shield: One of the standout features of a land trust is its ability to keep your name off public records. If discretion is your game, this could be a significant advantage.

- Asset Protection: In case of lawsuits, the assets held within a land trust can be shielded from personal creditors, providing a safety net you may not get with other methods.

- Ease of Transfer: You can seamlessly transfer beneficial interests without the headaches of formal property sales.

Living Trust: The Family Guardian

- Avoiding Probate: A living trust can be a powerful tool for bypassing the often lengthy probate process. Your heirs get access to your assets faster, which can be a real blessing during difficult times.

- Comprehensive Estate Planning: This option allows you to outline how your assets will be managed if you become incapacitated, ensuring your wishes are followed.

- Flexibility: Unlike a land trust, a living trust can include various asset types, not just real estate. This makes it a versatile choice for a broader estate strategy.

Also, your decision may depend on your specific needs whether you value privacy, asset protection, or a streamlined transfer process. Take the time to weigh your options carefully. Your real estate holdings deserve the best structure for your unique situation.

Privacy Protection: Land Trusts vs. Living Trusts

When it comes to privacy, I’ve noticed that many people get confused between these two types of trusts. They both sound alike but operate quite differently. If you’re like me, you’d want to ensure your financial and personal information stays under wraps, especially in today’s world.

Land Trusts are more about keeping your ownership of real estate discreet. The beauty here is that your name doesn’t appear on public records, making it an effective tool for maintaining privacy. If you’re an investor with multiple properties or just someone who values their anonymity, a land trust can shield you from prying eyes. But remember, it’s not a magic bullet it’s mostly for real estate holdings.

On the other hand, Living Trusts come with a broader scope. They’re not just for privacy but also for managing assets during your lifetime and after. While they don’t give you the same level of anonymity as land trusts, living trusts allow for smooth asset transfer upon death without the messiness of probate. I’ve found these especially helpful when planning for the future, ensuring that your assets go where you want them to without the hassle of court involvement.

Key Differences in Privacy:

- Land Trust: Keeps real estate ownership confidential.

- Living Trust: Not as private, but ensures a seamless asset transfer without probate.

Also, privacy protection boils down to your personal needs. If you’re primarily concerned with shielding property ownership, land trusts win the day. But for those looking for more comprehensive control over their assets, living trusts can offer broader benefits with some trade-offs in privacy.

Estate Planning with Living Trusts and Land Trusts

Estate planning is like crafting a blueprint for the future. Trusts play a starring role, and two of the most interesting players in this world are living trusts and land trusts. These aren’t just dry legal tools they can add a strategic flair to how your estate is managed.

A living trust is like a safety net that you create while you’re alive. It’s flexible and allows you to control your assets even when you’re no longer calling the shots. Picture it as a backstage manager ensuring the show goes on seamlessly.

On the other hand, land trusts are more like secret keepers. They can keep the ownership of property confidential, offering protection from prying eyes. Imagine wanting to own a piece of land but not have your name up in neon lights this is where a land trust quietly steps in.

Each has its superpower: living trusts help you avoid the tangled mess of probate court, while land trusts add a layer of privacy that some find essential. I’ve seen people benefit immensely from using both, depending on their needs, and often, they work together like two sides of the same coin.

The key to making the right choice is understanding your goals. Whether it’s protecting your privacy or streamlining your asset management, these trusts are more than legal jargon they’re tools that shape the future.

Knowledge Base

What is a disadvantage of a land trust?

One disadvantage of a land trust is its limited asset protection. While a land trust can offer privacy for property ownership, it doesn’t provide the same level of protection against creditors as other trusts, such as irrevocable trusts. If the trust’s beneficiary is sued, the property within the land trust may still be at risk. Additionally, the cost of maintaining a land trust, including legal and administrative fees, can sometimes outweigh its benefits, particularly for smaller properties or those in low-risk areas.

What’s the difference between a land trust and a regular trust?

A land trust specifically deals with real estate and allows for anonymity of ownership, meaning the trustee holds the title, while the beneficiary retains control over the property. In contrast, a regular trust, such as a living trust, can hold a variety of assets like stocks, bonds, and cash, and is often designed to manage and distribute those assets to beneficiaries. Additionally, land trusts are typically revocable, while regular trusts can be revocable or irrevocable, impacting control and asset protection.

What is the disadvantage of a living trust?

A common disadvantage of a living trust is its complexity and the initial setup cost. Living trusts require a significant amount of paperwork to ensure that all assets are properly transferred into the trust, which can be time-consuming. Furthermore, ongoing maintenance is required to update the trust if new assets are acquired. Legal fees can be higher compared to simpler estate planning tools like wills, making it less appealing for individuals with smaller estates.

Which states have land trusts?

Land trusts are most commonly used in states like Florida, Illinois, and California, where laws are particularly favorable to this type of arrangement. However, other states, such as Indiana, Virginia, and Massachusetts, also allow the creation of land trusts. The legal framework and protections may vary significantly depending on the state, with some offering greater flexibility and privacy benefits than others.

What is the disadvantage of a land trust?

Another disadvantage of a land trust is its limited legal recognition in certain states. Not all states have statutes specifically supporting land trusts, which could limit their effectiveness in some jurisdictions. Moreover, while a land trust provides privacy, it doesn’t necessarily offer substantial protection against liabilities such as lawsuits, which can expose beneficiaries to risks if they are not adequately insured or prepared for potential claims against the property.

What is the major disadvantage of a trust?

The major disadvantage of a trust, particularly irrevocable trusts, is the loss of control. Once assets are transferred into an irrevocable trust, the grantor no longer has control over them, as they are now managed by the trustee. This can be problematic if the grantor’s financial needs or circumstances change. Additionally, setting up and maintaining a trust can be costly, with legal and administrative fees adding up over time, which may outweigh the benefits for smaller estates.

Which of the following options is a disadvantage of a trust?

One of the notable disadvantages of a trust is the complexity of asset management. Trusts require careful handling of legal documents and ongoing maintenance to ensure that assets are properly managed and beneficiaries receive their distributions according to the trust’s terms. This complexity often necessitates the hiring of legal and financial professionals, leading to higher administrative costs. For smaller estates or less complex financial situations, simpler estate planning tools like wills may be more cost-effective.

What are the arguments against community land trusts?

Critics of community land trusts (CLTs) argue that they can limit personal wealth accumulation for homeowners. In a CLT, homeowners typically cannot sell their property at market value, as resale restrictions are put in place to maintain affordability. This can hinder their ability to benefit from property appreciation. Additionally, some argue that the management structure of CLTs can be cumbersome, with decision-making processes involving multiple stakeholders, which can slow down improvements or changes to the property.

What is the best trust to put property in?

The best trust to place property in depends on individual goals. For privacy and control, a land trust may be ideal as it keeps ownership confidential. However, for asset protection and estate planning, an irrevocable trust offers stronger safeguards against creditors. A revocable living trust is another popular option, providing flexibility in managing the property during the grantor’s lifetime while ensuring smooth transfer to beneficiaries after death, without going through probate.

What is a distinguishing characteristic of a land trust?

A key distinguishing characteristic of a land trust is its ability to provide anonymity to the property owner. In a land trust, the legal title is held by the trustee, while the beneficiary’s name remains private, offering a layer of confidentiality. This can be advantageous for individuals who wish to keep their ownership of real estate private, whether for personal, financial, or strategic reasons. Additionally, land trusts allow the beneficiary to retain control over the property without having their name on public records.

I completely resonate with your breakdown of land trusts and living trusts! The analogy of a land trust being a specialist while a living trust is a generalist really clarifies their roles in estate planning. I remember when I was first navigating through my own estate planning, I felt like I was drowning in legal jargon. Your emphasis on privacy benefits of land trusts is spot on; it’s such a game-changer! Plus, the notion of keeping ownership discreet can alleviate a lot of worries. I also appreciate how you highlight the importance of consulting a professional. It’s true having someone knowledgeable on your side can transform a confusing process into a streamlined journey. Thanks for sharing such valuable insights!

I absolutely love your analogy of the living trust as a treasure chest! It really simplifies a concept that can seem daunting to many. The way you illustrate how control transitions smoothly to a successor trustee is not just comforting but incredibly empowering. Knowing that I can avoid the probate process while keeping my affairs private is a huge relief! It’s like having a safety net that protects not only my assets but also my loved ones. I appreciate you breaking this down so clearly; it makes the idea of setting up a living trust so much more approachable. Thank you for sharing your personal experiences; it truly resonates with me!

What a refreshing take on land trusts! I love how you describe them as a ‘quiet guardian’ for our properties. The idea that we can keep the benefits of ownership while enjoying the shield of privacy is appealing. It’s fascinating to think about how adaptable these structures are. They truly cater to everyone, not just the affluent. I’m definitely going to share this insight with friends who could benefit from this knowledge!

I couldn’t agree more about the transformative potential of land trusts! When I first learned about them, it was like a light bulb went off. The privacy and flexibility they offer are game-changers, especially for those of us looking to preserve natural spaces. I’ve seen families successfully use land trusts to protect family farms from development, ensuring they stay in the family for generations. It’s such a relief knowing that you can maintain control over your property while keeping it out of the limelight. Thanks for shedding light on this valuable tool it’s definitely worth considering for anyone managing real estate!

Your insights on the different types of trusts are incredibly enlightening! I especially love the comparison of revocable trusts to a flexible safety net; that really resonates with me. It’s comforting to know that we can adjust them as life changes. I also think your mention of special needs trusts highlights an important aspect of estate planning that often goes unnoticed. It’s fantastic that these trusts can provide support without jeopardizing government aid. Charitable trusts are another area I find fascinating combining philanthropy with financial strategy is such a win-win! Your post has sparked a lot of thoughts for me about how to best structure my own trusts, and I’m looking forward to exploring more options. Thanks for sharing this valuable information!

I couldn’t agree more about the balance between protecting property and planning for the future! It’s so true that the type of trust you choose can shape your control over the assets, and I’ve seen firsthand how the details can really trip people up. When I was setting up my own estate planning, I went through a similar struggle but eventually settled on a revocable trust. It provided the flexibility I needed while still feeling secure. Your analogy of a foundation for a house is spot on! It’s such an important metaphor strong choices really do save you from future headaches. Thanks for the reminder to take our time with these decisions; our future selves will indeed thank us!

I really appreciate your breakdown of land trusts versus living trusts! It’s such a vital topic that often gets overlooked. Personally, I lean towards land trusts for real estate because I like the privacy they offer; it feels like having a secret weapon in the property game. But I totally get why some would prefer a living trust for broader asset protection. It’s like choosing between a stealthy ninja and a wise sage, each serving a purpose depending on one’s goals! I also found your point about control to be insightful. It really made me think about how much autonomy I want over my assets. I’ll definitely be diving deeper into this area, as it feels like a financial puzzle worth solving. Thanks for sharing your knowledge on this complex topic!