How Long Can a Lawyer Hold Money in Trust

How long can a lawyer hold money in trust? That’s the million-dollar question, isn’t it? From my experience, the answer often surprises people, and it’s not as straightforward as you’d think. I’ve encountered clients who assumed their lawyer could hold funds indefinitely, while others feared their money was gone forever if it stayed in a trust account for too long. The reality is that there are rules, and lawyers must follow them carefully.

Typically, lawyers are obligated to hold money in trust only for a purpose that serves their client. Once that purpose is fulfilled, the funds should be released promptly. However, how long this takes can vary. Let’s break it down:

-

Specific Instructions: Sometimes, the trust is held according to very specific client instructions, such as until a property sale closes or a settlement is finalized.

-

Completion of Legal Matters: Lawyers might need to hold the funds until certain legal procedures are fully completed this could be weeks, months, or even years in complicated cases.

-

Third-Party Conditions: Sometimes, the release of funds depends on the actions of third parties, such as courts, other lawyers, or government bodies, which can delay things beyond anyone’s control.

As someone who’s navigated through this with clients more times than I can count, I know that understanding the process helps reduce stress. And here’s my advice: always ask your lawyer to explain the timeline and conditions under which your money will be held. It’s your right, and knowing the answer to ‘How long may funds be kept in a lawyer’s trust account?’ could save you a lot of sleepless nights.

Understanding How Long Can a Lawyer Hold Money in Trust

Let me tell you, dealing with funds held in trust is not as straightforward as people think. There’s a reason these accounts exist, and it’s all about safeguarding someone’s money until the right moment. Lawyers manage this money with a sense of duty, but there’s more to it than simply holding onto it indefinitely.

You might be wondering why the funds stay in trust for what can sometimes feel like an eternity. The truth is, there are specific situations that dictate how long a lawyer can retain these funds. It’s not up to the lawyer alone to decide, but rather the circumstances of the case that play the biggest role.

I’ve seen cases where everything wraps up quickly, and the money is disbursed in no time. But, in others, legal or procedural hurdles pop up, creating delays that stretch the timeline. Sometimes, all parties involved need to meet specific conditions before the lawyer can release the funds, and that adds to the wait.

Clients often feel uneasy during this holding period, which I completely understand. But from my perspective, the real priority is ensuring that every ‘i’ is dotted and every ‘t’ is crossed. Rushing through it might mean risking someone’s financial interest, and that’s a gamble no responsible lawyer would take.

So if you ever find yourself in a situation like this, just know that patience is key. It’s about doing things right, not fast. In my experience, good things often come to those who wait, especially when it involves trust accounts.

Introduction to Lawyers Holding Funds in Trust Accounts

Trust accounts are more than just a safe place for funds. When lawyers hold money on behalf of clients, they often use these accounts to keep the funds secure until the moment they’re needed. I’ve handled countless cases where trust accounts play a pivotal role in transactions whether it’s during a real estate deal or a complicated legal dispute. These accounts are meant to protect the client, ensuring their money is not mixed with the lawyer’s personal or business funds.

The process of holding funds in trust is not as simple as opening an account and letting the money sit there. Lawyers have to follow strict rules and regulations to ensure everything is handled properly. Here are some of the key things you need to know:

- Separate accounts: Lawyers must use trust accounts that are distinct from their own operational accounts.

- Detailed record-keeping: Every transaction involving the trust account must be recorded meticulously. From the deposit to any eventual disbursements, documentation is key.

- Periodic reviews: Trust accounts are regularly reviewed, either by the lawyer’s internal team or even external auditors, to ensure compliance with local regulations.

As someone who’s worked with these accounts frequently, I can tell you that the timing and rules around how long funds stay in a trust can vary. There are always timelines dictated by legal or contractual requirements, but those are often tailored to the specific situation at hand. This isn’t something to take lightly mismanagement of these funds can lead to serious legal consequences for everyone involved.

At the end of the day, trust accounts are about safeguarding the client’s interests. When managed properly, they help build confidence between the lawyer and the client, setting the foundation for a smooth legal process.

Understanding Trust Accounts and Their Purpose

When realizing the world of trust accounts, it’s like opening a treasure chest of financial precision and security. Trust accounts are not just another banking option; they are crucial tools that play a pivotal role in various transactions and legal situations. Here’s a glimpse into their purpose and functionality.

Purpose of Trust Accounts:

- Safeguarding Funds: Trust accounts are primarily designed to hold money on behalf of someone else. Whether it’s a real estate transaction, a legal settlement, or a personal estate, these accounts ensure that funds are kept safe until the specific conditions set by the trust are met.

- Ensuring Compliance: They help in adhering to legal and ethical standards. For instance, lawyers are required to manage client funds with transparency and accountability, and trust accounts facilitate this by segregating client money from the lawyer’s own finances.

- Managing Complex Transactions: Trust accounts are indispensable in handling complex transactions where funds need to be disbursed under specific conditions or timelines. This can include scenarios such as divorce settlements or inheritance distributions.

Key Features:

- Separate Accounts: Money in a trust account is kept separate from other personal or business funds. This separation is vital for maintaining the integrity of the trust’s purpose.

- Interest Accumulation: Depending on the jurisdiction, trust accounts may earn interest. The handling of this interest whether it benefits the trust’s beneficiaries or goes to the lawyer can vary.

- Detailed Records: Trust accounts require meticulous record-keeping. This ensures that every transaction is documented and traceable, providing clarity and accountability.

In my experience, the effectiveness of trust accounts comes down to their ability to provide both security and clarity. They act as a financial safe harbor, where funds are protected and properly managed until the time comes to fulfill the intended purpose. Trust accounts might seem like a financial formality, but they are a cornerstone of trust and integrity in managing and protecting assets.

Legal Requirements for Lawyers Managing Client Funds

Managing client funds is one of the most delicate aspects of legal practice, and there are strict guidelines to ensure everything runs smoothly. From my experience, the devil is in the details, and lawyers must be meticulous in following these legal requirements.

One of the key obligations for lawyers is keeping client funds separate from their own. This means setting up a dedicated trust account, which acts as a secure holding space for the client’s money. I’ve seen cases where small errors in handling trust accounts led to big headaches, and trust me, you don’t want to go down that road.

Here’s a brief rundown of what I follow when managing client funds:

- Segregation: Always keep client funds separate from your firm’s operational accounts. Never mix them, even temporarily.

- Detailed Records: Maintain meticulous records. Every deposit, withdrawal, and transfer should be documented, along with the purpose of each transaction.

- Prompt Disbursement: Once the legal matter is settled, ensure that the funds are disbursed without unnecessary delays. Prolonged holding can lead to complications or even ethical complaints.

- Regular Reconciliation: I make it a habit to reconcile the trust account monthly. It’s easier to catch discrepancies early than deal with them later.

- Compliance with Local Rules: Each jurisdiction has specific rules regarding client funds. I always stay updated with local regulations because they can change and catching up too late can be costly.

I’ve found that clear communication with clients about how their funds are being handled helps build trust and avoid misunderstandings. If you make it a practice to be transparent and compliant, the risk of issues reduces dramatically. At the end of the day, it’s all about accountability.

How Trust Funds Are Typically Used in Legal Matters

Trust funds often serve as a bridge between legal obligations and the prudent management of finances. In my experience, they are used as a safeguard for clients, ensuring that their money is handled with the utmost care.

When engaging with a legal matter, these funds act as a financial vault. They hold the client’s funds securely until specific conditions are met, often related to legal fees or settlements.

Picture a delicate dance where money changes hands only when the right steps have been taken. This method adds an extra layer of accountability, which can be incredibly reassuring for clients navigating complex legal waters.

Moreover, trust funds can also play a role in the disbursement of settlement amounts. They ensure that the beneficiaries receive their due amounts in a timely manner, reducing the risk of misunderstandings or disputes.

For instance, I’ve seen situations where clients were anxious about their settlements. Knowing their funds were in a trust provided peace of mind, allowing them to focus on recovery rather than financial uncertainties.

In essence, trust funds are not just a financial tool; they are a testament to the fiduciary duty lawyers uphold. They embody a commitment to transparency, ensuring that every dollar is accounted for until the legal matters have reached their conclusion.

Trust is vital in these scenarios, and trust funds are the embodiment of that principle. They remind us that managing finances in legal matters is about more than just numbers; it’s about integrity and respect for the client’s wishes.

Time Limits for Holding Client Money in a Trust Account

When handling client money in a trust account, one of the first things to understand is the timeframe. From my experience, it’s crucial to balance two priorities: ensuring the funds are held securely and distributing them promptly when needed.

There are often specific regulations and deadlines in place for how long client funds can remain untouched. These deadlines can vary, but failing to meet them can lead to consequences, both legal and reputational. So, it’s not just about having the funds in a safe place; it’s about moving them along when the time is right.

Here’s a basic framework to follow:

-

Regulatory Guidelines: Always refer to the local regulations. Some jurisdictions have a hard deadline of 30, 60, or even 90 days, while others allow more flexibility depending on the case.

-

Purpose of the Funds: If the money is intended for a specific transaction, such as a real estate purchase, it should only stay in the trust account until that deal is finalized. Once the transaction is completed, the funds need to be moved out.

-

Client Communication: Always keep the client in the loop. Whether it’s fees being held or settlement money, a clear timeline should be communicated from the outset.

-

Administrative Holds: Occasionally, delays might occur due to outstanding paperwork or unresolved disputes. In such cases, it’s wise to document everything and explain to the client why their money is still being held.

The key takeaway? Timing is everything. The trust account isn’t a storage unit for funds; it’s a temporary stop. Managing that timeframe efficiently is crucial to maintaining trust and avoiding legal pitfalls.

The Complete Picture of How Long Can a Lawyer Hold Money in Trust

You might be surprised at how much control attorneys have when it comes to holding onto client funds in trust accounts. It’s not as simple as putting money in a box and waiting for instructions. Trust accounts have rules that govern them, and these rules can be stricter than you might think.

In my experience, lawyers manage these accounts carefully, often juggling multiple factors. Let’s break it down:

-

Purpose-driven funds: Lawyers hold money for specific reasons settlements, fees, or real estate transactions, for example. The purpose of the funds often determines how long the money stays in the account.

-

Triggering events: Sometimes, it’s not a matter of time, but an event. Maybe it’s the resolution of a legal dispute, or final paperwork being signed. Money can sit in trust until all the pieces of the puzzle fit together.

-

Client consent: While the funds may technically belong to the client, they don’t have free rein to demand the money at any time. Lawyers must adhere to legal obligations and protect both the client and third parties involved.

-

Ethical obligations: There’s also a moral layer here. Attorneys have to make sure they don’t hold onto the money longer than necessary, while also ensuring they don’t release it prematurely.

There’s a delicate balance involved. From my experience, it’s essential to understand that legal regulations, ethical duties, and client needs all factor into how funds are handled. So, while the timeframe may vary, one thing remains consistent: lawyers are bound by rules designed to safeguard the client’s interests.

Conditions That Affect How Long Lawyers Can Hold Client Funds

With regard to handling client funds, one question frequently arises: ‘How Long Can a Lawyer Hold Money in Trust?’ It’s a topic that often generates confusion and curiosity, especially for clients wondering about their hard-earned cash.

In my experience, various conditions can dictate the duration for which attorneys can retain these funds. For instance, a lawyer must hold the money until it is clear whether the client has an outstanding bill. It’s a balancing act between maintaining trust and ensuring financial responsibilities are met.

Another factor is the nature of the case. If the funds are part of a settlement, they may be held until all conditions are satisfied. This might include waiting for the client to fulfill specific obligations or for court approval.

Moreover, jurisdictions have different rules governing trust accounts. Understanding the local regulations is crucial. I’ve seen clients frustrated when they aren’t aware of these stipulations; knowledge can empower you in these financial matters.

Sometimes, a lawyer may need to hold funds for an extended period due to unforeseen circumstances. The legal landscape is ever-evolving, and maintaining transparency during this time is paramount.

In essence, while the timeframe can vary, open communication with your attorney can clarify the situation. Keeping that dialogue active is beneficial.

So, the next time you ponder, ‘Duration of a lawyer’s trust fund holding?’ remember that it’s a multifaceted issue influenced by several factors. A bit of patience and understanding can go a long way in navigating these waters.

Factors Influencing the Duration of Trust Fund Retention

Regarding the retention of trust funds, a lot of elements come into play. It’s not as simple as just putting the money in a secure place and leaving it there indefinitely. From my experience, a few key factors influence how long those funds will remain untouched.

First and foremost, the purpose of the trust itself is a major determinant. If the trust is set up for a specific event like the sale of property or settlement of a legal case then the funds are typically retained until those conditions are fully met. However, other trusts could be held over a more extended period if they are intended for long-term objectives.

Now, let’s not forget the role of external factors. A few of the common ones are:

- Regulatory requirements: Depending on the jurisdiction, trust fund retention may be subject to specific legal guidelines. These guidelines set the parameters on how long the funds can be held, and stepping outside them is not an option.

- Administrative processes: Sometimes, trust funds stay put longer simply because of bureaucratic hurdles whether it’s waiting for proper documentation or obtaining signatures from all involved parties.

- Beneficiary timelines: If the trust is created to benefit a minor or someone with a future need, the funds may need to remain locked up for years.

A final but crucial point: trust fund managers, including legal representatives, often have fiduciary duties that require them to balance due diligence with efficiency. Holding onto the funds too long might raise questions, but moving too fast could leave someone shortchanged.

In short, while the timeline can vary, each case should be assessed individually, considering these and other specific factors.

When Must Lawyers Release Trust Funds to Clients?

In my time navigating legal circles, I’ve learned that trust funds in a lawyer’s hands can be a delicate matter. The timing of releasing these funds depends heavily on certain key moments in the legal process.

One of those moments is when all conditions tied to the case have been satisfied. These could be settlement terms, closing of a property deal, or even a court judgment. Only once those are clear can funds shift from the lawyer’s grasp to the client’s hands.

But, here’s a crucial point: lawyers aren’t allowed to hang onto client funds any longer than necessary. While the law may not give you a specific countdown clock, it emphasizes that there should be no ‘extra’ time taken for purely administrative reasons.

For instance, I’ve seen scenarios where paperwork lag or payment delays slowed the process. Yet, the moment all legitimate concerns are cleared up, the lawyer has an obligation to act swiftly.

That being said, lawyers also have a fiduciary duty. If there’s a dispute about how much should be released, they may hold back just the contested portion. This can keep everything fair until both sides settle the disagreement.

What I always tell clients is this: Stay informed, stay in communication with your attorney, and don’t hesitate to ask about the status of your funds. Transparency is key when handling trust funds, and you have a right to know the timeline.

How State and Local Laws Regulate Trust Accounts

With respect to trust accounts, state and local laws aren’t just guidelines they’re the guardrails that keep everything in check. I’ve seen firsthand how these laws can vary wildly depending on where you’re practicing. It’s not a simple one-size-fits-all situation, but there are some common threads.

For starters, trust accounts are special bank accounts used to separate client funds from business funds. Different jurisdictions have different rules on how these accounts must be set up and maintained. But one thing is clear: mismanaging a trust account can land you in hot water faster than you can imagine.

Let me break it down for you. These are some of the ways state and local laws typically regulate trust accounts:

- Segregation of Funds: Trust accounts must always keep client money separate from your personal or business finances. Mixing funds? That’s a quick way to trouble.

- Recordkeeping Requirements: Detailed records are essential. Many states demand that you keep ledgers showing every penny coming in and going out, often for years after the case has been settled.

- Timely Disbursement: Once a client’s money is due, you can’t just sit on it indefinitely. States often have strict timelines for when those funds must be released.

- Account Reconciliation: In some places, you’ll need to reconcile your trust account regularly, sometimes even monthly, and you’ll better be prepared to show proof if an audit comes knocking.

Navigating these regulations can be a minefield, but keeping a tight ship is crucial. The risk isn’t just to your license it’s your reputation on the line. So, trust me when I say, staying on top of your state’s specific laws will save you a lot of headaches in the long run.

Ethical Obligations for Lawyers Handling Trust Accounts

Ethical obligations for lawyers handling trust accounts are not just a matter of rules; they’re the heartbeat of our profession. I’ve seen firsthand how a mishandled trust account can lead to a cascade of consequences, undermining both the lawyer’s reputation and the client’s trust.

When managing client funds, transparency becomes our guiding star. Clients deserve clarity about how their money is being handled. I’ve always believed that open communication fosters trust, and trust is the bedrock of our relationships with clients.

In my practice, I’ve often stressed the importance of meticulous record-keeping. Every transaction, no matter how small, needs to be documented. It’s not just about compliance; it’s about honoring the responsibility we take on when we accept client funds.

Moreover, there’s an ethical obligation to keep personal and client funds separate. Mixing these funds can lead to ethical breaches and legal ramifications that can be avoided with diligence. It’s essential to create a system that upholds this separation effortlessly.

Let’s not forget the importance of periodic audits. I’ve found that regular reviews of trust accounts can catch errors before they snowball into significant issues. Being proactive is key in this area.

Also, adhering to ethical standards while handling trust accounts isn’t just about avoiding pitfalls; it’s about cultivating a practice that reflects integrity and professionalism. Remember, our actions speak volumes, shaping the very foundation of our legal careers.

Common Reasons for Delays in Releasing Trust Money

From my experience, one of the most frustrating things clients face is waiting for their trust money to be released. You might think it’s a quick and straightforward process, but several factors can stretch the timeline far beyond what anyone expects. Let’s break down some of the common culprits for these delays.

-

Administrative Hiccups – Sometimes, it’s not the legal intricacies that slow things down but simple paperwork or processing errors. Missing signatures, incorrect documentation, or even miscommunication between parties can all cause unnecessary holdups.

-

Regulatory Requirements – Trust money isn’t just sitting in an account waiting to be handed over. There are strict protocols governing how funds are handled. Compliance with these regulations can introduce extra steps, especially if there are changes in the law or new financial regulations come into play.

-

Third-Party Delays – Lawyers often have to coordinate with external entities, such as banks or government agencies. These third parties don’t always operate on a tight schedule, leading to inevitable waiting periods. Something as simple as waiting for a bank clearance can add days to the process.

-

Dispute or Disagreement – Trust funds can sometimes be the subject of contention between parties. Maybe someone is questioning how the funds should be divided or whether all obligations have been met. In these cases, the lawyer is obligated to hold the funds until the matter is resolved.

-

Complicated Legal Matters – In some cases, the complexity of the legal situation itself is the main barrier. If there are tax issues, unresolved claims, or ongoing court actions, the release of funds might be postponed indefinitely.

Remember, delays don’t always mean something is wrong it’s often just part of the process. But it’s important to stay in communication with your lawyer and ask about specific timelines based on your situation.

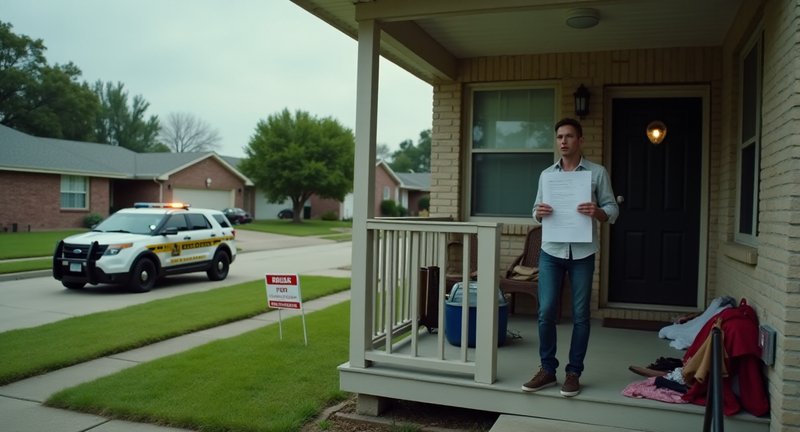

What to Do If Your Lawyer Holds Money Too Long

When you’ve handed over funds to your lawyer, it’s not unreasonable to expect things to move forward smoothly. But what happens if your lawyer holds onto that money for longer than you expected? Believe me, you’re not the first person to face this frustration. I’ve seen it before, and it’s important to know what steps you can take if things start dragging out.

First, communication is key. Reach out to your lawyer and ask for a clear explanation. Sometimes delays can be legitimate, whether it’s due to procedural issues or waiting on other parties. However, if the answer feels vague or you’re not getting a straight response, it might be time to take more concrete steps.

Here’s a quick checklist of actions to consider:

- Request a written update on why the funds are still being held.

- Review your contract to see what it says about holding funds and timelines.

- Keep a record of all communications with your lawyer, just in case things need to escalate.

If your lawyer still isn’t budging or providing satisfactory reasons, you might need to go a step further. Filing a complaint with your state bar association is one route. And I know, no one wants to go down that road, but sometimes it’s necessary to ensure your funds are handled properly.

Also, it’s about staying informed and proactive. Don’t be afraid to question or push back if something doesn’t seem right after all, it’s your money at stake.

Info & Answers

Why is my lawyer holding my settlement?

A lawyer may hold your settlement to ensure that all outstanding debts, such as medical bills or legal fees, are paid before releasing the remaining funds to you. This is a legal obligation to protect all parties involved and prevent future disputes. Additionally, some funds may be held in escrow until certain conditions are met, such as the completion of paperwork or confirmation that liens have been resolved.

How long can money sit in escrow?

Money can sit in escrow for as long as it takes to fulfill the terms of the escrow agreement. In legal or real estate contexts, this might range from a few days to several months. Typically, escrow periods are determined by the complexity of the transaction or settlement process, and once all conditions are satisfied, the funds are released promptly. If there are complications, like disputes or delays in document processing, the money may remain in escrow longer.

How long are settlement checks good for?

Settlement checks are generally valid for six months (180 days) from the date they are issued. However, this can vary depending on the policies of the issuing bank or institution. If you fail to cash a check within this timeframe, the bank may mark it as void, and you would need to request a reissuance. It’s important to cash or deposit your settlement check promptly to avoid any complications or delays.

Do banks put a hold on settlement checks?

Yes, banks can place a hold on settlement checks, especially if the check is for a large amount. The hold allows the bank to verify that the check is legitimate and that there are sufficient funds in the issuing account. The length of the hold can vary, typically lasting between 2 to 7 business days, depending on the bank’s policies and the size of the check. During this time, the funds may not be immediately available.

What is the longest a settlement can take?

The length of a settlement process can vary significantly depending on the complexity of the case, the willingness of both parties to negotiate, and any legal hurdles. While some settlements are resolved in a matter of weeks, others can take months or even years. In extreme cases, a settlement might be delayed by legal disputes, appeals, or challenges related to collecting compensation. The longest a settlement can take often depends on the specifics of the litigation process.

What’s the most a lawyer can take from settlement?

Lawyers typically take a percentage of the settlement amount as their fee, known as a contingency fee. This percentage can range from 25% to 40%, depending on the complexity of the case, the state laws, and the attorney’s agreement with the client. In most cases, lawyers cannot take more than 33-40% of the settlement. However, additional costs such as court fees, expert witnesses, and other expenses may be deducted from your settlement before you receive the remaining balance.

Why do lawyers hold money in escrow?

Lawyers hold money in escrow to ensure that all financial obligations related to a case are met before the client receives their portion of the settlement. This includes paying medical providers, lienholders, or any other third parties who have a legal right to claim a portion of the funds. Escrow accounts are secure and legally regulated, ensuring that funds are distributed fairly and in compliance with legal requirements, protecting both the lawyer and the client.

What is the longest escrow period?

The length of an escrow period depends on the specific terms of the escrow agreement and the transaction being conducted. In real estate, escrows typically last between 30 to 60 days but can extend up to six months or longer if there are complications, such as financing issues or disputes. For legal settlements, escrow periods may last until all parties have met their obligations, which can extend the process if disputes or delays arise.

Who owns the money in an escrow account?

The money in an escrow account is technically owned by the party or parties involved in the transaction, but it is held by a neutral third party, such as a lawyer or escrow agent, until all terms of the agreement are met. This third party manages the funds impartially and ensures that they are only disbursed when the specific conditions of the escrow agreement have been fulfilled, ensuring a fair and legally compliant process for all parties.

This is so spot-on! I’ve seen people get frustrated waiting for funds, not realizing that the lawyer has their hands tied until everything is fully settled. And you’re absolutely right about transparency. I’ve been on both sides waiting for a settlement to come through and working with an attorney who kept me updated every step of the way, which really helped ease the process. When you mention disputes over portions of funds, it reminds me of a case I was involved in where the lawyer held back the contested amount while we sorted things out. It felt fair, and it avoided escalating any tension. Staying informed is key, as you said communication makes all the difference!

This really resonates with me, especially the part about balancing due diligence with efficiency. I once saw a trust fund get delayed for what felt like ages because of administrative hiccups, and it taught me how complex the whole process is. You nailed it when you said that holding funds for too long raises questions, but rushing could shortchange someone. It’s such a tricky balance! And I couldn’t agree more with assessing each case individually. With all those external factors, it’s clear that there’s no “one-size-fits-all” when it comes to trust fund management. Thanks for breaking this down so clearly always good to see the nuances laid out like this.

I’ve always wondered about this! It can be super confusing as a client when your money is sitting in a trust account, especially if you don’t fully understand all the factors behind it. It makes total sense that things like unpaid bills or court conditions can affect how long the funds stay there. I’ve seen a situation like this drag on, but knowing it’s more about legal processes and less about the lawyer just “holding on to the money” would have eased a lot of frustration. Communication really is key in these cases.

I had no idea attorneys had so much control over trust accounts! It’s pretty interesting how the rules go beyond just “waiting for instructions” from the client. Juggling all those factors must be tough, but I guess that’s why they have those ethical and legal obligations in place. Definitely a delicate balance!

This is a really important point! I’ve dealt with trust accounts before and making sure the timing is right really can’t be overstated. Balancing legal deadlines with the client’s needs is a bit of a juggling act. It’s good to see you mention documenting everything when things get held up communication is everything in these situations! The last thing anyone wants is a legal issue just because of a simple delay. Definitely agree, the trust account is temporary, not a place to park funds long term.

I love how trust funds are like that bridge between clients and their peace of mind! It’s such a relief for them to know their money is handled with care while they wait for settlements.

Managing client funds can be such a tightrope! Keeping them separate from firm accounts is a rule I stick to like glue, for sure. I once worked with a lawyer who had an issue with delayed disbursements, and it caused such a mess! Your point about prompt disbursement really hit home because clients get nervous when there are delays, even if they’re small. Regular reconciliation is also so underrated. I’ve seen firsthand how easy it is to miss small errors if you don’t stay on top of it. These guidelines are lifesavers when it comes to staying compliant and avoiding those dreaded ethical complaints.

This breakdown of trust accounts is spot on! I remember setting up my first one for a real estate transaction and being amazed by how much structure it brought to the process. The separation of funds is crucial; it’s like having an extra layer of protection, ensuring that everything goes smoothly and by the book. Plus, I hadn’t realized how much of a role they play in legal situations like divorce settlements! It makes total sense now. The interest accumulation part is interesting, too. Not every jurisdiction does it, but when they do, it’s a nice little bonus. The accountability and transparency that trust accounts offer really help build confidence in any transaction. Totally agree with the ‘financial safe harbor’ analogy!

I completely agree with this! Trust accounts are such an important part of making sure that everything in a legal case runs smoothly and transparently. The fact that lawyers have to keep such detailed records and separate accounts is really reassuring, especially when dealing with something like a real estate deal. I’ve been through that process, and knowing the funds were safe until everything was finalized definitely helped me sleep better at night! It’s great that there are regulations in place, too keeps everything above board. Mismanagement of funds would be a nightmare, but it sounds like a good system when done right!

This really resonates with me! It’s so true that dealing with trust funds isn’t always as quick as people hope, but the focus on ensuring everything is done properly makes total sense. When you’re dealing with large sums of money, it’s better to have every detail checked than to rush it. I went through a similar process when my lawyer held funds after a settlement, and while the waiting was tough, I appreciated how thorough they were. You’re right patience is definitely key. Better to have peace of mind knowing it’s being handled with care than to regret rushing through it!

I’ve always wondered how long a lawyer can hold onto funds in a trust! It’s surprising to hear that the timeline can vary so much depending on the situation. I can totally see how some people would get nervous if their money was in limbo for what seems like forever, especially if there’s a lot at stake, like with a property sale or settlement. Your advice to ask the lawyer about the timeline upfront is spot on! It’s easy to forget that we can (and should) ask those questions. It’s our money after all, and having clarity about the process could really help with the stress. I know a friend who was in this situation, and she had no idea she could request updates on where things stood. I’ll definitely pass along your tips to her! Thanks for breaking it down so clearly.