Getting Started with Fake Insurance Card

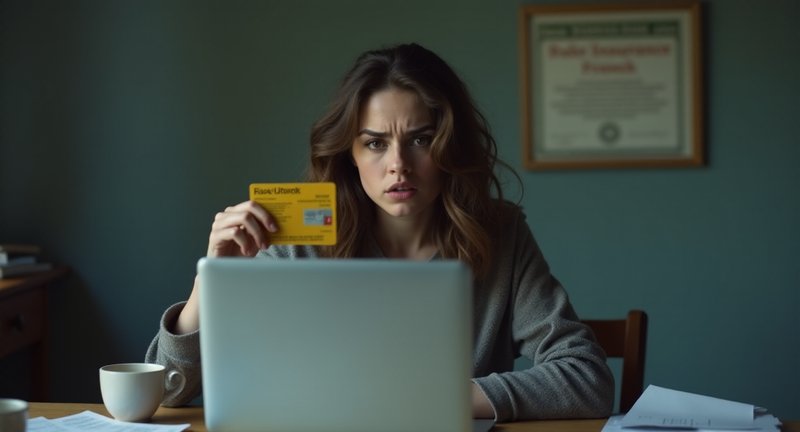

Let’s dive into something a bit unconventional ‘Fake Insurance Card.’ Maybe you’ve heard whispers, or perhaps curiosity brought you here, but this concept is more prevalent than you might think. First things first: this is definitely a risky venture. But, hey, let’s break it down and talk strategy, shall we?

What Exactly is a ‘Counterfeit insurance card’?

Simply put, it’s a fabricated document designed to mimic a legitimate insurance card. Some people use it to cut corners, but there’s more to this than just having a card to flash when needed. This might sound clever, but trust me, it’s a thin ice situation.

Why People Use It

People might consider a ‘Fabricated coverage proof’ for a number of reasons, including:

- Short-term convenience: When people can’t afford proper insurance or face an urgent situation.

- Avoiding high costs: Some are tempted to use one to bypass hefty medical bills.

- Access to services: In situations where proof of insurance is required but inaccessible, this seems like a tempting option.

Risks Involved

Here’s the catch: though the idea of a ‘Mock insurance documentation’ might seem like a smart workaround, there are major risks.

- Legal Consequences: Being caught with a bogus insurance card can lead to serious charges, from fraud to identity theft.

- Financial Damage: You’re not only risking fines, but also the possibility of being blacklisted by insurers in the future.

- Ethical Dilemma: Yes, it raises serious moral questions. Is it worth the potential downfall?

A Word of Caution

From personal experience, I’ve seen people attempt shortcuts like these, but they rarely end well. It might feel like a quick fix, but the long-term consequences can far outweigh the short-term gain. So, take a breath, weigh the options, and make sure you fully understand what’s at stake.

The Risks of Using a Fake Insurance Card

Navigating the world of insurance is already complex enough, but using an altered or fraudulent proof of coverage can make things infinitely worse. I’ve seen firsthand how tempting it can be to cut corners when faced with high premiums or rejection, but the consequences are far from trivial.

Imagine presenting a doctored insurance document only to have it unravel in the face of a claim. It’s like walking a tightrope over a pit of financial disaster. When the real deal comes to light, the fallout can be devastating, not just financially but legally.

You might think that slipping a falsified document past the gatekeepers is a victimless crime, but it’s not. The insurance industry is tightly regulated, and any attempt to deceive it can lead to severe repercussions. Penalties range from hefty fines to imprisonment, making the risks simply not worth it.

Additionally, if you’re caught in the act, your credibility and future insurance prospects could be permanently tarnished. Picture yourself trying to get coverage in the future, only to be met with skepticism and inflated rates because of past deceit.

In the end, it’s essential to approach insurance with honesty. The short-term gains from manipulating documents pale in comparison to the long-term damage to your financial health and personal integrity. It’s always better to deal with the real challenges rather than create new ones.

What is an Illegitimate Insurance Document?

What exactly constitutes an illegitimate insurance document? Let’s break it down. Imagine you’re heading out for a drive, feeling secure with your insurance coverage. Then, out of the blue, an officer asks for proof of that coverage. You pull out your card, confident it’s all set until you realize it’s not valid.

An illegitimate insurance document is a cleverly deceptive piece of paper or digital record. It mimics a legitimate insurance policy but lacks the necessary validity. Now, this could happen for a variety of reasons, and I’ve seen my fair share of them in the world of insurance.

Here are some common scenarios where you might encounter this type of document:

- Expired policies that continue to be used without renewal. The dates look fine on the surface, but the policy’s no longer active.

- Forgery where someone physically alters or digitally manipulates the document, often adjusting policy numbers or coverage dates.

- Policies sold by unauthorized agents who provide documentation that appears official but is not backed by a legitimate insurance company.

- Documents from defunct companies that no longer exist or are unlicensed in your area, rendering the coverage void.

In these cases, you might unknowingly end up with an illegitimate document, putting you at risk. This can lead to denied claims, penalties, or even legal trouble. So, how can you spot one? Look for unusual formatting, errors in the insurer’s name, or mismatched policy numbers. These red flags can tip you off that something’s amiss.

From personal experience, it’s always worth double-checking your coverage directly with the insurer, especially if you’re dealing with an unfamiliar agent or company. Better safe than surprised!

Why Some People Resort to Invalid Insurance Papers

In the intricate world of business and finance, I’ve encountered a myriad of scenarios where individuals opt for dubious insurance documents. This isn’t merely a case of a few bad apples; it’s a complex issue with a range of motivations and consequences. Let’s realize why this happens and what drives people down this precarious path.

Motivations Behind Using Invalid Insurance Papers:

-

Financial Strain: In times of economic hardship, the temptation to use dubious documents can seem like a quick fix to avoid high premiums or coverage gaps. It’s a desperate measure born out of financial desperation, where the immediate relief overshadows the long-term risks.

-

Lack of Awareness: Sometimes, it’s not malicious intent but sheer ignorance. Individuals may not fully grasp the legalities or the severe implications of their actions. They might be lured by seemingly harmless options, unaware of the potential consequences.

-

Cultural Norms: In certain regions, the use of such documents might be more normalized or overlooked. People in these areas may see it as a common practice, rather than an unethical breach.

-

Complexity of Regulations: The labyrinthine nature of insurance regulations can bewilder many. When faced with a convoluted system, some might resort to alternative methods, thinking it’s a viable shortcut.

Consequences of Resorting to Invalid Insurance Documents:

-

Legal Repercussions: The legal fallout from using falsified documents can be severe. It includes fines, criminal charges, and long-lasting damage to one’s financial reputation.

-

Coverage Denials: If the deception is discovered, legitimate claims might be rejected. This not only leaves individuals without support when they need it most but can also amplify financial distress.

-

Ethical Dilemmas: Beyond the tangible consequences, there’s the personal toll. Engaging in fraudulent practices can lead to a significant ethical burden and stress.

Navigating the world of insurance can be daunting, but understanding these motivations and consequences is crucial. It’s a reminder that while shortcuts may seem tempting, they often lead to more significant issues down the road.

The Legal Risks of Using a Fraudulent Insurance Certificate

Let me tell you, navigating the complexities of insurance can feel like a minefield, but there’s one thing you definitely want to avoid: playing fast and loose with an insurance certificate that isn’t legit. The legal risks tied to this can have lasting consequences that can put your business, reputation, and even personal finances in jeopardy.

Here’s why you should steer clear:

-

Civil Penalties: Getting caught using a falsified certificate can land you in court facing hefty fines. And we’re not talking about pocket change penalties can reach into the thousands.

-

Criminal Charges: In more severe cases, it’s not just a civil issue; you could be staring down criminal charges. This could mean misdemeanor or even felony charges depending on the extent of the fraud and jurisdiction. Jail time is not something anyone wants to plan for in their schedule.

-

Loss of Coverage: If you’ve presented a fraudulent certificate, don’t expect any mercy from your insurer. Upon discovery, they’ll likely drop you like a hot potato, leaving you without coverage when you need it most.

-

Business Impact: Think about how this could affect your relationships with clients and partners. Once the trust is broken, it’s hard to rebuild. And if you operate in a regulated industry, losing insurance can halt operations or even result in a loss of licensure.

But that’s not all. Using an illegitimate certificate could mean long-term damage to your professional reputation. People talk, and word spreads fast in any industry. You don’t want to be the name on everyone’s lips for the wrong reasons.

To sum it up, avoid the quick fix of a fraudulent certificate. It’s just not worth the risk.

Spotting the Signs of a Counterfeit Insurance Card

In my years navigating the labyrinth of insurance policies, I’ve encountered my fair share of dubious documents. If you’re like me and have a keen eye for detail, here’s how to spot a questionable insurance card before it leads you astray.

-

Examine the Quality: Authentic cards are crafted with precision. They boast a smooth finish and high-resolution print. If you notice a card with blurry text or uneven edges, consider it a red flag.

-

Check the Holograms and Watermarks: Genuine insurance cards often feature security elements like holograms or watermarks. These are difficult to replicate. Run your fingers over the card authentic ones have textured features that fakes often miss.

-

Look for Inconsistencies: Verify the card details against the issuer’s records. Any discrepancies, such as a mismatched company logo or incorrect contact information, should raise suspicion.

-

Scrutinize the Barcodes and QR Codes: Scan these codes with a smartphone. If the codes don’t lead to a valid insurance provider’s site or return an error, you might be holding something less than legitimate.

-

Consult the Experts: When in doubt, seek confirmation from the insurance company directly. They can verify the card’s authenticity using their internal systems.

Remember, while these tips might not cover every angle, they offer a solid foundation for distinguishing genuine cards from the impostors. Always stay vigilant, and don’t hesitate to question what doesn’t look right.

The Dangers of Driving with Unverified Insurance

Imagine you’re driving down the road, minding your own business, when suddenly, you’re pulled over by law enforcement. They ask for your insurance card, and you confidently hand it over. But here’s the twist: it’s not real. You’re driving with a Fake Insurance Card, and trust me, that’s a situation you never want to find yourself in.

Let me break down why this is such a dangerous game to play:

- Legal Consequences: If caught with unverified insurance, you could face hefty fines, license suspension, or even jail time. It’s no slap on the wrist, I can tell you that.

- No Financial Protection: In the event of an accident, you’re completely exposed. Without valid coverage, you’re paying out of pocket for damages both yours and potentially the other party’s. It’s a financial nightmare waiting to happen.

- Loss of Trust: Once authorities flag you for fake insurance, your credibility takes a serious hit. Future insurers may hike your premiums or outright refuse to cover you.

I once knew someone who tried to save a few bucks by using a Counterfeit insurance document. They thought they were outsmarting the system, but it turned out to be one of the most expensive mistakes they could make. It’s a little like thinking you’ve found a shortcut, only to realize it’s led you straight into a pitfall.

So, if you’re tempted to cut corners with unverified insurance, ask yourself: Is risking your future for temporary savings really worth it? I wouldn’t bet on it.

How Authorities Detect Fake Insurance Proofs

When dealing with identifying counterfeit insurance documents, authorities have become quite sophisticated. Over the years, I’ve seen a few interesting methods evolve. So, how do they catch on? Let me break it down.

-

Verification via Digital Systems: Today, most insurance providers are linked to national databases. If someone presents a questionable insurance document, authorities can instantly verify its validity by cross-referencing it with official records. It’s amazing how fast technology exposes a false claim.

-

Inspection of Document Details: One trick I’ve noticed is that authorities often check for subtle errors. For instance, they’ll zoom in on the font, alignment, or even the quality of the paper used. Official documents have a certain precision – a counterfeit one? Not so much.

-

Inconsistent Policy Numbers: Fraudsters may create believable policies, but they often overlook small technicalities like policy numbers. Each legitimate policy follows a specific format unique to the insurer. Authorities can spot a fake just by recognizing that the number doesn’t fit the standard pattern.

-

Interaction with the Insurer: If there’s still doubt, law enforcement will reach out directly to the insurer. This step removes any remaining guesswork. By contacting the insurer, they quickly confirm whether the document is legitimate or part of an elaborate ruse.

It’s fascinating how these small yet critical steps make a huge difference. Each little clue piles up, making it almost impossible to get away with presenting an invalid insurance document.

Insurance Fraud: How Fake Documents Harm the Industry

Insurance fraud is a sneaky menace that undermines the integrity of our financial systems. I’ve seen firsthand how fraudulent documents can wreak havoc on the industry.

Imagine a scenario where someone concocts a phony document to claim insurance benefits. It’s not just about the deceit; it’s about the ripple effect on legitimate claims and premiums. The insurance sector is like a delicate ecosystem, and tampering with it disturbs the balance.

When these deceptive papers make their way into the system, the cost is ultimately passed on to honest policyholders. It’s frustrating to see how one person’s greed can lead to higher premiums and reduced coverage for everyone else.

In my experience, tackling this problem requires vigilance and robust verification processes. It’s crucial for insurance companies to have stringent checks to detect and prevent such deceptions. We need to protect the industry from these cunning ploys to ensure that it serves its true purpose offering financial security when we need it most.

Also, the battle against fraudulent documents is about preserving trust in an industry that many depend on. So, let’s stay sharp and work together to keep these devious schemes at bay.

Common Misconceptions about Using Forged Insurance Papers

When people think they can cut corners with insurance, they often don’t see the bigger picture. One of the most common blunders is assuming that forged papers are a quick and harmless fix to bypass high premiums or avoid dealing with legalities. Trust me, from what I’ve seen, it’s rarely as simple as people believe.

The assumption is that no one will bother checking the authenticity of documents in detail. Unfortunately, that’s far from the truth. Insurance companies, along with law enforcement, are constantly upgrading their verification methods. It’s easier to get caught than most expect, and the consequences aren’t pretty.

There’s also the belief that using such papers is a victimless move. But that misconception is where trouble really starts. If a claim is made, and it’s uncovered that the insurance is forged, the financial burden falls squarely on the individual. Worse yet, legal repercussions can escalate, leaving them in deeper trouble than they ever anticipated.

People often think it’s a one-time risk – get through this moment, and they’re in the clear. The reality? These forged documents can haunt someone down the line. Records are often kept for years, meaning a simple mistake now can come back to bite you when you least expect it.

From experience, I’ve seen that it’s always better to face higher premiums or complicated processes head-on. In the long run, the cost of honesty is far cheaper than the consequences of deception. And believe me, when things go wrong, they go very wrong.

Real Consequences: What Happens When You’re Caught

When you venture into the murky waters of deceit, the risk of getting caught is ever-present. Let’s dive into the real-world repercussions of getting tangled up in fraudulent insurance schemes.

Imagine the scene: you’re cruising along, thinking everything’s under control, only to have your world flipped upside down by the revelation of your scheme. Here’s what can happen:

-

Legal Trouble: The moment you’re caught in fraudulent activities, you’re staring down the barrel of a legal gun. You might face hefty fines and even prison time. It’s not just a slap on the wrist these are serious charges with serious consequences.

-

Financial Fallout: Beyond the legal troubles, you’ll be hit with financial repercussions. Legal fees, restitution payments, and possibly losing your assets. This isn’t a minor inconvenience; it’s a full-scale economic disaster.

-

Damage to Reputation: In the world of finance, reputation is everything. Once you’re marked as fraudulent, your credibility is shattered. This can affect your ability to secure future employment or do business.

-

Personal Consequences: The stress and anxiety that come with being caught can take a toll on your mental and physical health. Relationships might suffer, and you could face a significant personal crisis.

It’s a harsh reality that catching someone in a web of deception isn’t just a minor setback. It’s a storm that can destroy your life on multiple fronts. So, while it might seem tempting to cut corners, the risks far outweigh any fleeting gains. Stay on the straight and narrow it’s not just about avoiding trouble; it’s about safeguarding your future.

The Truth About Fake Insurance Card

In the matter of insurance, there’s a lot more to worry about than simply losing your policy number. A far greater risk is the rise of counterfeit insurance documents. I’ve seen firsthand how people get caught up in this mess thinking everything’s squared away, only to discover too late that their “coverage” is nothing more than a cleverly designed illusion. And let me tell you, it’s not something you want to experience.

Let’s break it down:

-

Unintended Consequences: You might think you’re saving a buck by using a questionable insurance document. But when it comes time to file a claim, you’re left holding an empty bag. And no one wants that shock when they realize they’re completely uncovered.

-

Legal Trouble: Driving without valid insurance, even unknowingly, can land you in legal hot water. Fines, penalties, and even license suspension are very real possibilities. Not to mention, the courts don’t tend to sympathize with “I didn’t know.”

-

Financial Risk: Imagine getting into an accident. You think your insurance will handle the costs, but in reality, you’re on your own. Medical bills, property damage, and lawsuits could snowball into financial ruin.

From my own experience, dealing with insurance is complex enough. The last thing anyone needs is to fall victim to false promises or shady providers. It’s not just about getting a good deal it’s about ensuring you’re genuinely protected when life throws curveballs.

So, how can you avoid this? Always verify your provider through official channels, check for valid licensing, and if something feels off, trust your gut and walk away.

Penalties for Presenting False Insurance Credentials

Let me tell you, folks, nothing can make your stomach drop faster than getting caught presenting false insurance credentials. It may seem like a small gamble, but the consequences? They’re anything but minor. In my experience, people who try to pull a fast one often think it’s a shortcut to avoiding premiums or sneaking past a few regulations, but what follows is a lot more costly than you might expect.

Let’s break it down:

-

Fines that Sting: Financial penalties are no joke. Depending on where you live, you could be looking at fines ranging from a few hundred to several thousand dollars. Trust me, that’s a hard pill to swallow for a gamble that doesn’t pay off.

-

Legal Trouble: Presenting false documents can land you in legal hot water. In some cases, we’re talking about misdemeanors, but in others, it escalates to felonies. Ever thought about jail time? Yeah, that’s on the table too, depending on the jurisdiction.

-

Suspended or Revoked Licenses: Driving without valid insurance can get your license yanked faster than you can say ‘big mistake.’ It’s not just the license, either your vehicle registration could also be on the chopping block.

-

Future Insurance Nightmares: Even if you manage to dodge jail time, the insurance companies won’t forget. Getting back on the road with legit insurance afterward is going to cost you. Your premiums will soar, and you might even find yourself on the dreaded ‘high-risk driver’ list.

Long story short cheating the system with dodgy insurance credentials isn’t just a risky move; it’s a guaranteed headache. Do yourself a favor and steer clear. It’s just not worth the aftermath.

The Impact on Your Driving Record and Reputation

When you hit the road, your driving record is more than just a collection of numbers it’s a living document that tells a story. Imagine cruising through life, only to find that a shadow looms over your reputation because of a misstep that could have been avoided.

In my experience, the moment you rely on dubious documentation, you’re not just risking fines; you’re gambling with your credibility. A tarnished record can be a heavy anchor, pulling you down when it comes to insurance rates or job prospects that involve driving.

It’s astonishing how one decision can ripple through your life like a pebble tossed into a calm pond. Employers may question your judgment, insurers might raise their rates, and friends may cast wary glances your way. You don’t want to be that person who is always looking over their shoulder, wondering when the repercussions will come knocking.

Let’s not sugarcoat it: the consequences can be as sticky as spilled soda on a summer day. The anxiety of facing potential legal issues or having your vehicle impounded can overshadow the thrill of the open road.

In the grand scheme of things, maintaining a clean record is akin to nurturing a delicate flower. It requires consistent care and attention. So, take a moment to reflect on your choices and the legacy you want to leave behind on the asphalt highways of life.

Remember, every journey begins with a single step or in this case, a well-informed decision. Protect your reputation like it’s your most prized possession, because, in the end, it truly is.

Financial Liabilities When Accidents Involve Fake Insurance Claims

Dealing with financial liabilities when accidents involve fraudulent insurance claims is a tricky affair. You might think the paperwork is enough of a headache, but that’s just the start.

When someone presents falsified coverage, it throws a wrench into the usual process. The other party could be left holding the bill for damages, leading to unexpected financial burdens. I’ve seen cases where legitimate claims get delayed for months while insurers sort out the mess.

For businesses, this can be especially harmful. Imagine losing both time and money chasing compensation that was never there. It’s not just a simple loss it’s like a crack that keeps growing if not handled promptly.

Now, if you’re a private individual, you’re not off the hook either. An accident with someone carrying bogus paperwork can cost you far more than repairs. Legal fees, wasted time, and endless back-and-forths can pile up quickly.

I always recommend verifying coverage details the moment an accident happens, even if things seem in order at first. Catching discrepancies early can save you a world of trouble later on. But it takes vigilance because, in my experience, insurers aren’t going to hurry up to fix something they didn’t cause.

In a nutshell, if an accident drags you into the world of insurance fraud, expect more than just the typical hassles. Prepare for financial frustrations, because they’ll show up quicker than any help from the system. It’s a wake-up call no one wants, but one you need to be ready for.

Frequently Asked

How does proof of insurance look?

Proof of insurance typically appears as an official document issued by your insurance provider. It includes important details like the insured individual’s name, the policy number, the coverage start and end dates, and a description of the insured vehicle (make, model, and year). The document may also feature your insurance company’s contact information and a barcode or QR code for verification. It can be printed on paper, displayed on your phone, or downloaded as a digital copy through your insurer’s website or mobile app.

How do I edit my car insurance card?

You cannot directly edit your car insurance card, as it is an official document issued by your insurance company. If you notice an error or need to update information, you must contact your insurance provider. They will make the necessary changes, such as updating personal information, vehicle details, or policy coverage. Once updated, the insurer will issue a new, corrected insurance card. If you’ve made changes to your policy (e.g., added a vehicle), you’ll also receive a new card reflecting those updates.

How to check genuine insurance?

To verify whether your insurance is genuine, you can contact your insurance company directly or check their official website to validate the policy details. Many insurers provide an online portal where policyholders can log in and view their coverage status. You can also verify the insurance through state insurance department websites or databases that track active policies. Additionally, the insurance card itself may have verification codes or watermarks to distinguish genuine documents from fraudulent ones.

Can someone steal your identity with your insurance card?

Yes, your insurance card contains personal information that could potentially be used for identity theft, such as your name, policy number, and other identifying details. Criminals may use this information to file false insurance claims, commit medical fraud, or access other personal data linked to your insurance account. It’s important to keep your insurance card safe, avoid sharing it with unauthorized parties, and notify your insurer immediately if it’s lost or stolen.

How to get an insurance copy online?

To obtain an insurance copy online, log into your insurance company’s website or mobile app using your registered account credentials. Most insurers offer the ability to download or print a copy of your insurance card directly from their online portal. If you’re unable to access it, you can contact customer support for assistance. Some companies may also email you a digital copy upon request. Having access to your online account allows for quick and easy retrieval of this document.

What is proof of insurance called?

Proof of insurance is commonly referred to as an “insurance card” or “insurance certificate.” It serves as a formal document that verifies you have an active insurance policy and outlines the details of your coverage. It’s also known as a “proof of coverage” or “evidence of insurance” in some cases. This document is crucial when registering a vehicle, renewing a license, or during traffic stops where law enforcement requests confirmation of insurance.

What is proof of coverage?

Proof of coverage is an official document issued by your insurance provider that confirms your active insurance policy. It lists essential information such as the insured individual’s name, policy number, coverage dates, and details of the insured asset, whether it’s a vehicle, home, or health policy. Proof of coverage is required in various scenarios, such as vehicle registration, real estate transactions, or medical claims. It is essentially the same as proof of insurance, confirming that you are protected by an insurance policy.

How to show proof of insurance to the DMV NJ?

To show proof of insurance to the DMV in New Jersey, you can provide either a physical insurance card or a digital version on your smartphone or tablet. The card must display the necessary details, including the policyholder’s name, vehicle information, and insurance coverage dates. New Jersey DMV also accepts faxed or emailed copies directly from your insurance company if requested. Ensure the insurance is current and matches the vehicle you’re registering to avoid issues during the process.

What states require proof of insurance?

Nearly all U.S. states require drivers to carry proof of insurance, but the specifics vary. For example, states like California, New York, and Texas require proof of insurance to be shown during traffic stops, vehicle registration, and accidents. However, some states such as New Hampshire don’t mandate car insurance unless the driver has certain violations. States like Arizona and Washington allow digital insurance cards, while others still require a physical copy. Check your state’s regulations for exact requirements.

What is the source document used to verify insurance coverage?

The primary source document used to verify insurance coverage is the insurance card or insurance certificate issued by your provider. This document contains all necessary details about the policy, including coverage dates, the policyholder’s information, and the insured vehicle’s description. Additionally, for more in-depth verification, policy declarations or a binder (temporary insurance proof) may be used, particularly in cases involving real estate or business insurance.

I couldn’t agree more about the impacts of insurance fraud! It’s like a ticking time bomb for the industry. When someone creates a fake document, the fallout doesn’t just hit them; it shakes up everyone who plays by the rules. I’ve been in discussions where we talked about how these fraudulent actions can lead to higher premiums for all of us honest folks. It’s frustrating to see one person’s greed ripple through the system. Your call for vigilance is so important! It’s crucial for insurance companies to implement rigorous checks to catch these sneaky schemes early. Keeping the trust intact in our financial systems is vital for ensuring that insurance can serve its purpose of providing us with peace of mind. Let’s all stay alert and support efforts to safeguard this essential service!

This is such an eye-opener! I had no idea about the methods authorities use to identify counterfeit documents. The tech side of it is really impressive makes you wonder how anyone thinks they can get away with fraud nowadays! It’s like trying to pull a fast one in a world that’s always watching. Those small details you mentioned, like font and paper quality, are so crucial. It just goes to show that the devil really is in the details!

Wow, what a vivid scenario! It really drives home the dangers of using fake insurance cards. I once heard a story about someone who got pulled over with a counterfeit card and ended up in a massive legal mess. It’s wild to think that just trying to save a few bucks could lead to such drastic consequences. This article does a fantastic job of highlighting the importance of valid insurance. It’s definitely not worth risking your future over a false sense of security. Better safe than sorry, right?

I love the practical tips you provided for spotting questionable insurance cards! As someone who has had to review numerous policies, I can say that a keen eye really does make a difference. The emphasis on quality and the presence of security features like holograms is spot on. I remember a situation where I received a card with a blurry logo and immediately suspected it was fake. It’s also great to see you highlight the importance of verifying details against the issuer’s records; that’s a step many overlook! Consulting the experts is often the best route when in doubt better safe than sorry! This advice not only empowers individuals to protect themselves but also fosters a culture of vigilance in the insurance sector. Thanks for such a thoughtful and informative post! I’ll definitely be sharing these tips with my network to help them navigate their insurance journeys more safely.

Wow, your breakdown of the legal risks associated with using illegitimate insurance certificates really hits home! I’ve seen firsthand how one bad decision can have a domino effect on a business. A friend of mine once used a falsified certificate to save on premiums, thinking it was harmless. Fast forward a few months, and he found himself facing hefty fines and a tarnished reputation. It’s a tough lesson but one that many could avoid with a bit more awareness. I particularly appreciate how you pointed out the long-term impacts, like the loss of trust from clients and partners. Once that trust is broken, rebuilding it is nearly impossible! It makes me wonder if we should have more educational programs or workshops focused on insurance literacy. It’s crucial for businesses to understand that the risks of a quick fix far outweigh any short-term benefits. Thanks for sharing such valuable insights it’s a wake-up call for all of us!

I completely resonate with your insights about the motivations behind using dubious insurance documents! It’s such a multifaceted issue that affects many people, especially during tough economic times. I remember a colleague who, overwhelmed by rising costs, opted for a questionable policy thinking it was just a temporary solution. Unfortunately, this quick fix only led to more significant problems down the line when his claims were denied, leaving him in a financial bind. It’s also fascinating how cultural norms can influence these decisions; in some communities, the use of such documents is almost an unspoken agreement among peers. Awareness is key! It’s vital for people to realize that while these shortcuts may seem tempting, they can lead to severe repercussions, both legally and ethically. Understanding the landscape of insurance and the potential risks of taking these shortcuts can help steer individuals toward better, more legitimate choices. Thanks for s

This is such a relevant discussion! I’ve encountered many people who have faced the nightmare of illegitimate insurance documents. It’s interesting to think about how easily one could be caught up in this web without realizing it. I once had a friend who thought he was covered only to discover that his policy was through a sketchy agent who wasn’t authorized. Talk about a rude awakening! Your breakdown of common scenarios is super helpful, especially for those who might not even be aware of the risks they’re taking. I love your advice on double-checking coverage; it can literally save you from a mountain of trouble down the road! And yes, those red flags you mentioned unusual formatting and mismatched policy numbers are things we should all keep an eye out for. Honestly, it’s a relief to read your insights on how to navigate this tricky landscape. Thanks for shedding light on such an important topic!

I love how you laid out the risks involved with using an altered insurance card! It’s so easy to underestimate how quickly a seemingly harmless act can spiral out of control. I remember a buddy of mine thought he could get away with presenting a fake card to save on premiums, and boy, did that backfire! It’s like trying to cheat in a game you might feel clever at first, but the consequences can be brutal. The fallout from getting caught is not only legal but can also damage relationships with insurers in the future. It’s wild to think how a single dishonest moment can haunt you for years to come. I wholeheartedly agree that honesty is the best policy here. I’m glad you highlighted the importance of addressing the real issues rather than creating new problems. Let’s keep promoting awareness around this!

Wow, this is such an eye-opening topic! I’ve often heard about people trying to use fake insurance cards, but I didn’t realize how risky it truly is. It’s easy to see why someone might consider cutting corners, especially when faced with high costs, but the potential legal repercussions seem far too steep. I agree with your cautionary advice it’s like a gamble that’s not worth taking! Instead of looking for a quick fix, why not explore other options? Many states offer assistance programs for those who genuinely can’t afford insurance, and getting legal advice might be more beneficial in the long run. I’ve learned from friends who took shortcuts that the stress and anxiety they faced after getting caught were far worse than just dealing with the costs upfront. Let’s keep the conversation going about safer alternatives for those in need!